Markets don’t often move in unison—but sometimes a single speech can flip the script. That’s exactly what happened this past week when Federal Reserve Chair Jerome Powell’s remarks at Jackson Hole reset expectations across the global financial landscape.

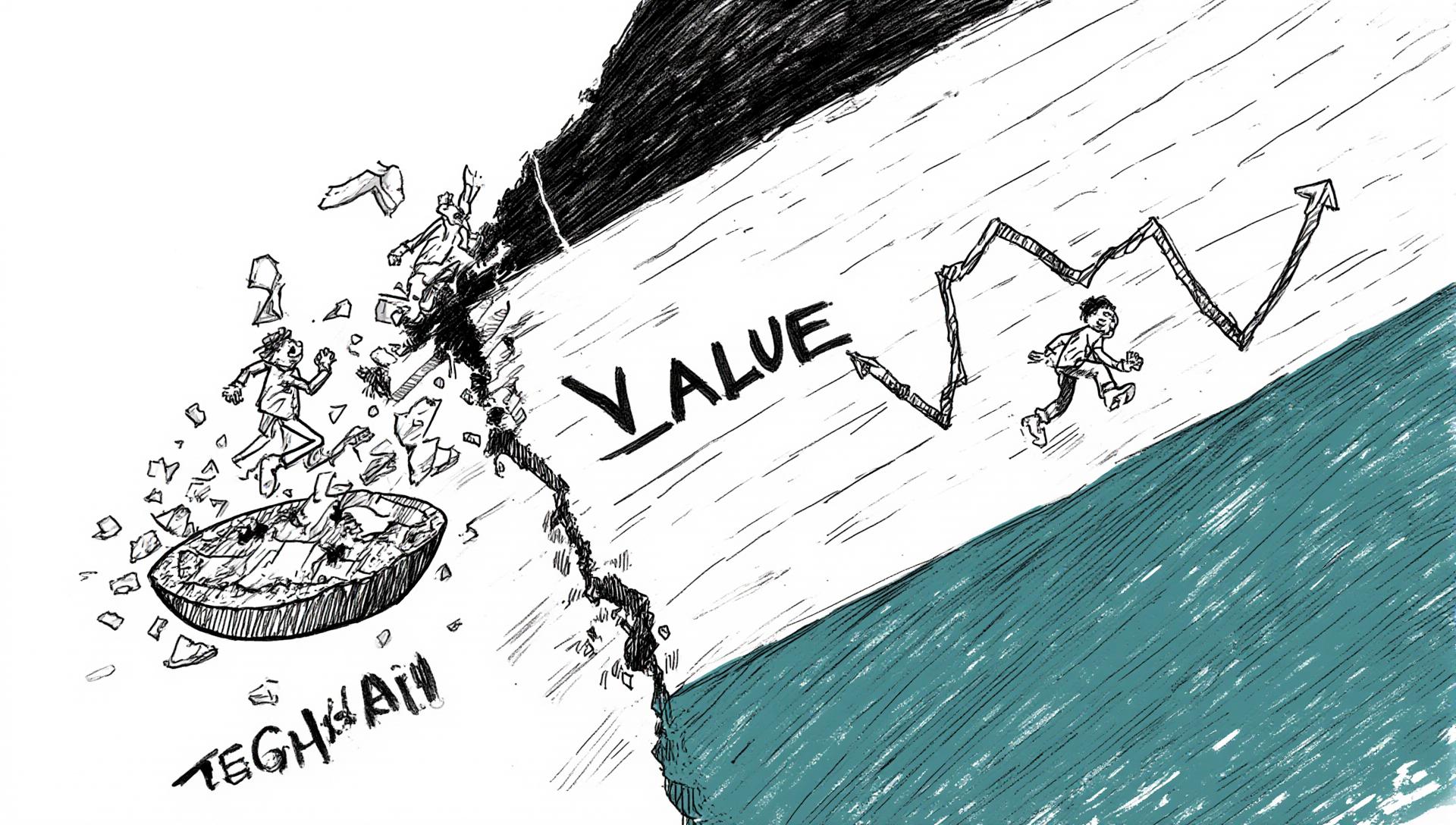

What looked like a hesitant, choppy week suddenly turned into a dramatic rally, led not by tech giants but by value stocks and small caps. The Dow surged to record highs, while the Russell 2000 and S&P MidCap 400 saw their best performances in months.

So, what does this sudden rotation mean for investors? And how should you prepare for what’s coming next? Let’s break it down.

Powell’s Message: A Subtle Tone, a Big Impact

Markets are incredibly sensitive to signals from central banks, and Powell delivered one that felt unmistakably dovish. He pointed to:

Rising risks to jobs

Tariff-driven inflation pressures

The acknowledgment that rates are already high

That last point was crucial. It suggested the Fed may be closer to cutting rates sooner than expected. Futures markets reacted instantly, with the FedWatch tool showing an 83% probability of a rate cut in September.

Yields fell, equities surged—especially in sectors most sensitive to borrowing costs like financials, energy, and materials.

A Week of Divergences in U.S. Equities

Dow Jones: +1.5%, hitting record highs

S&P 500: +0.3%, breaking a four-day losing streak

Nasdaq: -0.6%, dragged down by tech weakness

Russell 2000: +3.3%, small caps soared

S&P MidCap 400: +2.9%, another standout

This rotation reflects a market now favoring strong balance sheets and steady cash flows over pure growth. If the cost of money falls, cyclical sectors with real-world earnings power could take the lead.

The Economic Backdrop: Strength and Strain

The U.S. data picture was mixed:

Housing: Existing home sales rose +2% in July

Labor Market: Jobless claims ticked up to 235,000, suggesting softening

Business Activity: PMI hit 55.4, the year’s highest reading

Cost Pressures: Sharpest rise in input costs since May, largely blamed on tariffs

This tug-of-war between resilient demand and sticky inflation is precisely the Fed’s dilemma.

Europe: Business Upbeat, Consumers Cautious

In the Eurozone, growth momentum looks stronger. PMI data showed the fastest manufacturing expansion in three years, and Italy’s MIB index gained over 1.5%.

But consumer confidence slipped, showing a split between business optimism and household caution. Germany’s DAX remained flat, highlighting questions about sustainability.

UK: Growth vs. Inflation Puzzle

The FTSE 100 closed at record highs, gaining 2%. Yet inflation remains sticky, with CPI at 3.8% and services inflation climbing to 5%.

This puts the Bank of England in a tough spot—growth is holding up, but inflationary pressures mean the BOE may need to remain hawkish while other central banks turn dovish.

Japan: Inflation Pressures Intensify

The Nikkei 225 dropped nearly 2% as rising bond yields and sticky inflation raised expectations of another Bank of Japan rate hike. With 10-year JGB yields at a 17-year high, markets are bracing for a historic shift away from decades of ultra-easy policy.

China: Retail Mania and Leverage Risks

China’s CSI 300 jumped 4%, powered largely by retail investors. Margin debt is now at its highest level since 2015—just 10% below all-time records.

This raises concerns of a fragile, leverage-fueled rally that could quickly unwind if sentiment turns or regulators step in.

Key Risks for the Week Ahead (August 25–29)

U.S. Inflation (PCE Index, Aug 29): Hotter-than-expected data could derail hopes of a September rate cut.

Labor Market Weakness: Rising jobless claims could shift sentiment back to recession fears.

Tariff-Driven Input Costs: Supply-side inflation may squeeze corporate profits.

China’s Leverage Bubble: High margin debt leaves markets vulnerable to sudden shocks.

Diverging Central Bank Policies: The Fed leaning dovish while the BOJ and BOE stay hawkish creates FX volatility and global capital flow risks.

Conclusion: A Market at a Crossroads

This week’s rally showed the power of central bank messaging. Powell’s pivot breathed new life into value stocks and small caps, but whether this rotation has staying power will depend heavily on next week’s inflation and GDP data.

Globally, diverging central bank policies, consumer caution, and leverage risks in China create a complex environment for investors. Staying proactive, diversified, and attentive to signals from both policymakers and data will be critical in the weeks ahead.

FAQs

Why did small caps rally after Powell’s speech?

Because rate cut expectations favor companies sensitive to borrowing costs. Small and mid-cap firms often benefit disproportionately when money becomes cheaper.

What’s the biggest risk for markets right now?

The PCE inflation report. A hotter reading could upend hopes of near-term rate cuts and spike volatility.

How does China’s retail-driven rally affect global investors?

Excessive leverage in China creates contagion risk. A sharp correction could spill into emerging markets and beyond.

Why is Europe showing mixed signals?

Businesses are optimistic thanks to rising demand, but consumer confidence is lagging, raising concerns about sustainability.

What should investors focus on next week?

U.S. PCE inflation, GDP revisions, European inflation data, and Japan’s consumer confidence. These will all shape central bank policy expectations.

Hashtags

#FederalReserve #JeromePowell #StockMarket #Investing #ValueStocks #SmallCaps #InterestRates #Inflation #GlobalMarkets #JacksonHole #MarketUpdate #FinanceNews #PortfolioStrategy

Subscribe to our Newsletter

Discover more