The last week of August was anything but calm. A potent mix of crucial inflation data, shifting geopolitical sands, and unexpected central bank moves sent ripples across the globe. For investors, the lesson is clear: understanding not only what happened, but why it matters, and what it signals for the future, is essential to spotting opportunities and risks.

United States: balancing optimism and institutional strain

Despite global turbulence, U.S. equities ended the week with only modest losses. Surprisingly, small caps outperformed large caps for the third week in a row. Beneath the surface, however, the dynamics were far more complex.

President Trump’s decision to fire Federal Reserve Governor Lisa Cook sparked intense debate about the Fed’s independence. The subsequent court battle now challenges institutional credibility, raising long-term concerns about monetary policy’s very foundations.

On the corporate side, Nvidia once again exceeded expectations, reinforcing the strength of the AI narrative. Yet traders are increasingly asking whether these tech-driven gains are sustainable, signaling a delicate balance between enthusiasm and caution.

Meanwhile, the Fed’s policy signals are evolving. Governor Waller reiterated his call for a 25 basis point rate cut in September, citing a cooling labor market. Markets now price in an 89% chance of that cut. At the same time, Q2 GDP was revised upward to 3.3%, highlighting robust consumer and business spending. This paradox—stronger activity alongside a softening labor market—captures the tightrope the Fed must walk.

Gold surged to a record $3,518 an ounce, up 31% year-to-date, underscoring investors’ flight to safety. Yet with payroll data looming, the real test lies in whether the Fed can maintain credibility while navigating conflicting signals.

Europe: a divided central bank and sticky inflation

European markets painted a much darker picture, with sharp declines across major indices. Minutes from the European Central Bank’s July meeting revealed a deep internal split. Some members argued for easing due to downside risks, while others warned of persistent price pressures.

Adding fuel to the debate, Germany’s inflation rose to 2.1% and Spain’s held steady at 2.7%. These readings weakened the case for a September rate cut and highlighted just how opaque the ECB’s path remains.

Compounding the economic uncertainty, France’s political instability and ongoing Ukraine tensions dampened sentiment. In the UK, retail sales logged their 11th straight month of decline, signaling deep-rooted consumer pain. The core takeaway: Europe is trapped between sticky inflation, weak growth, and policy indecision.

Japan: a nation in transition

Japan’s markets offered a mixed picture, with the Nikkei rising slightly while the Topix declined. The Bank of Japan’s shifting tone remains at the center of attention.

Tokyo Core CPI slowed to 2.5%, still above the BoJ’s 2% target, signaling persistent inflation. Meanwhile, unemployment fell to 2.3%, its lowest since 2019, strengthening the case for tightening. But industrial output contracted by 1.6% in July, raising red flags over external demand and recovery prospects.

The BoJ is carefully preparing for normalization, but its approach will remain cautious to avoid stifling fragile growth.

China: liquidity-fueled rally masks fragility

China’s markets continued to rally, but the story looks less like genuine recovery and more like speculation. Margin debt climbed to its highest level since 2015, fueled by low deposit yields pushing retail investors into riskier assets.

Although industrial profits fell less than expected, broader data on retail sales, factory activity, and investment disappointed. Economists now widely expect September stimulus, but the scale and effectiveness of Beijing’s measures will determine whether the rally has real legs. For now, liquidity, not fundamentals, is driving the surge.

The week ahead: September 1st–5th, 2025

Global investors face a packed calendar of market-moving events:

Monday: U.S. Labor Day holiday, China Caixin Manufacturing PMI

Tuesday: U.S. ISM Manufacturing PMI, Eurozone flash inflation

Wednesday: U.S. JOLTS job openings

Thursday: U.S. ADP employment report

Friday: U.S. non-farm payrolls and unemployment rate, UK retail sales

Top five risks to watch

U.S. jobs report shock – Following July’s weak print, another disappointing report could accelerate Fed cuts and trigger recession fears.

Fed independence crisis – Political interference risks undermining credibility, steepening the yield curve, and spurring safe-haven flows.

Eurozone inflation resilience – Sticky inflation could delay ECB cuts, weighing on equities.

China stimulus timing – Underwhelming or delayed measures could cause a sharp market correction.

UK retail pain – Persistent declines may push stagflation fears higher and limit Bank of England policy options.

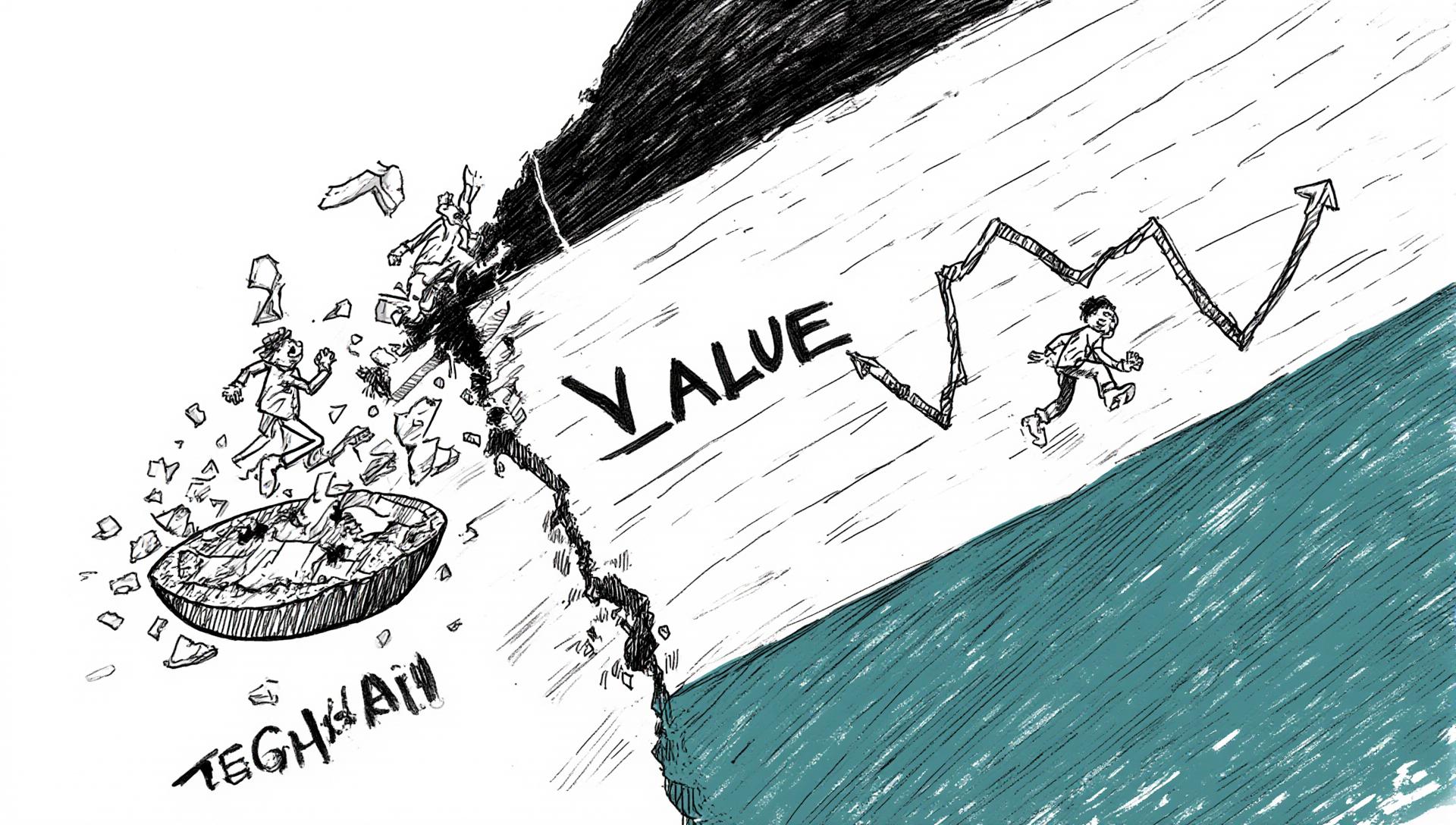

Final insight: exuberance vs. fundamentals

As September begins, global markets are caught between liquidity-driven optimism and sobering economic realities. The U.S. labor market, ECB policy divisions, Japan’s cautious path, and China’s fragile rally all underscore one truth: the balance of risks is tilting toward softness.

The pivotal question for investors is this: Will optimism continue to drive markets, or will fundamentals ultimately take control? The answer could define investment strategies for the remainder of 2025.

Frequently Asked Questions

Why did gold hit a record high in August 2025?

Gold surged past $3,500 an ounce as investors sought safety amid Fed uncertainty, inflation concerns, and geopolitical risks.

What is driving China’s stock market rally?

The rally is largely fueled by liquidity and retail speculation, not by underlying economic strength. Stimulus expectations are also playing a role.

How did the ECB react to Eurozone inflation data?

Rising inflation in Germany and Spain complicated the case for rate cuts, revealing deep divisions within the ECB.

Why is the U.S. jobs report so important right now?

It directly influences Fed policy. A weak report could accelerate rate cuts, while a strong one may delay easing.

What is the main risk for investors in September 2025?

The top risk is a potential disconnect between market optimism (fueled by liquidity) and underlying economic fundamentals such as weak growth and sticky inflation.

Hashtags

#MarketUpdate #GlobalMarkets #Inflation #FederalReserve #ECB #StockMarket #InvestmentStrategy #EconomicOutlook #AIStocks #ChinaEconomy #GoldPrices #LaborMarket #CentralBanks #FinanceNews

Subscribe to our Newsletter

Discover more