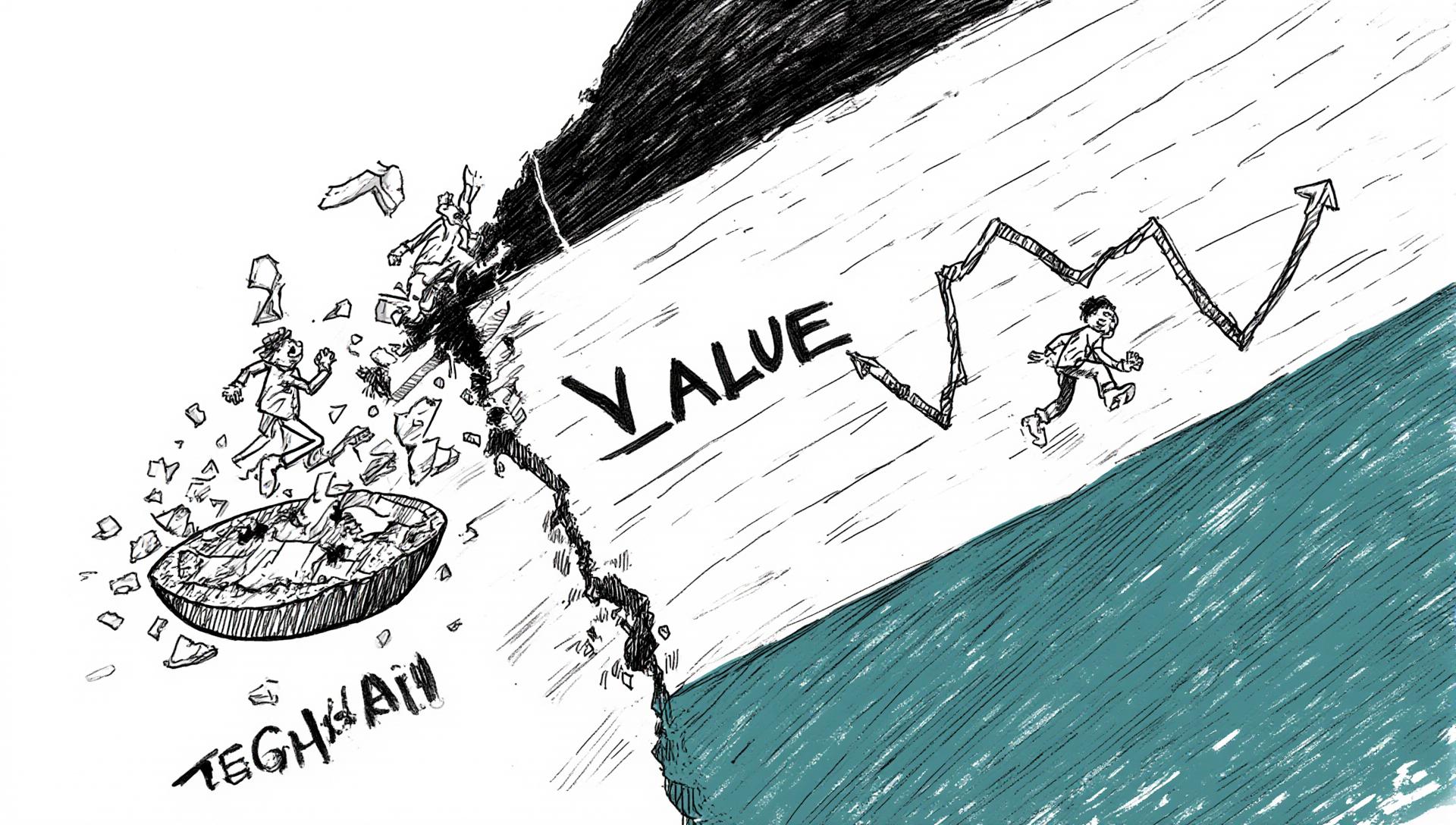

Hold onto your portfolios—because the week ending April 11, 2025, felt like a financial roller coaster for global markets. While the international spotlight remained firmly fixed on intensifying trade tensions, there was a lot more unfolding beneath the surface. From tariff tit-for-tats and surprising economic data releases to cautious pronouncements from central banks, markets around the world were left scrambling to keep up with a rapidly changing landscape.

U.S. Markets: A Significant Rebound Tempered with Important Caveats

Despite all the geopolitical noise and economic crosscurrents, U.S. equity markets posted strong weekly gains:

S&P 500: +5.7%

Nasdaq Composite: +7.3%

Dow Jones Industrial Average: +5.5%

Much of this impressive bounce stemmed from a wave of midweek optimism after the U.S. announced a temporary 90-day pause on certain tariffs. However, this rally proved to be short-lived. Tariffs on a range of Chinese goods were simultaneously hiked to a staggering 145%, and China swiftly responded with its own tariff increase to 125% on U.S. goods, reigniting market volatility towards the end of the week.

Federal Reserve Minutes and the U.S. Inflation Outlook

The minutes from the Federal Reserve’s March meeting revealed a persistently cautious stance among policymakers. The Fed appears caught between the ongoing challenge of persistent inflation and growing concerns over a potential slowing of economic growth. March CPI (Consumer Price Index) data showed a 2.4% year-over-year rise—the lowest reading since early 2021—offering some measure of relief on the inflation front. However, consumer sentiment dropped to its lowest level in nearly three years, with consumer inflation expectations spiking to 6.7%, a level not seen since 1981. This disconnect between actual reported inflation and heightened consumer anxiety is weighing heavily on overall economic confidence.

Europe: Facing Trade Headwinds and Signs of Internal Economic Weakness

In stark contrast to the gains seen in U.S. markets, European equity markets struggled during the week:

Euro Stoxx 600: -1.9%

Germany’s DAX: -1.3%

France’s CAC 40: -2.3%

Weaker-than-expected industrial production figures in both Germany and Italy, along with a sharp downgrade of Italy’s 2024 GDP growth forecast (from 1.2% down to 0.6%), significantly dampened investor sentiment. These internal economic vulnerabilities, combined with ongoing global trade frictions, left the Eurozone in a precarious position.

Central Bank Vigilance Across Europe

Both the European Central Bank (ECB) and the Bank of England (BoE) stepped up their monitoring of market conditions and economic data. The BoE notably delayed several gilt (UK government bond) auctions due to liquidity concerns in the market. Even as UK GDP data for February showed surprisingly strong growth (+0.5% month-over-month, +1.4% year-over-year), markets remained cautious. The FTSE 100 dipped 1.1%, reflecting the ongoing disconnect between some strong economic data points and broader market risk perceptions.

Japan: Experiencing Trade Pain with Only a Glimmer of Hope

Japan, though included in the temporary U.S. tariff pause on some goods, remained under a significant 25% levy on its auto exports to the U.S. This continued trade pressure weighed on Japanese equities:

Nikkei 225: -0.6%

The Japanese yen strengthened to 142 against the U.S. dollar as some investors sought safe-haven assets, a development that prompted concern from Japanese officials about the currency's impact on exporters. Despite the market volatility and trade concerns, Bank of Japan (BoJ) Governor Ueda reiterated the central bank's intention to normalize monetary policy, a stance that separates Japan from other global central banks currently leaning more dovish.

China: Market Slump Accompanied by Signals of Potential Stimulus

Chinese equity markets fell sharply during the week:

Shanghai Composite: -3.1%

Hang Seng (Hong Kong): -8.4%

While tariffs escalated between the U.S. and China, Beijing hinted at a strategy of strategic restraint rather than engaging in continued tit-for-tat retaliation. More importantly for markets, whispers of a new fiscal stimulus package from the Chinese government sparked a late-week rally in some assets. Economists warn that the implemented tariffs could shave 1–2 percentage points off China’s 2025 GDP growth, but many believe Beijing possesses the fiscal tools necessary to counterbalance much of this potential damage.

Key Economic Events to Watch: Week of April 14, 2025

United States:

Monday–Tuesday: U.S. Treasury auctions.

Wednesday: Retail sales, industrial production, capacity utilization, business inventories.

Thursday: Weekly jobless claims, housing starts, housing market index.

Friday: U.S. markets closed for Good Friday.

Eurozone:

Thursday: European Central Bank (ECB) interest rate decision (a 25 basis point cut is widely expected).

United Kingdom:

Thursday: Retail sales data.

Japan:

Monday: Final industrial production & capacity utilization (for February).

Tuesday: 20-year government bond auction.

China:

Tuesday: Q1 GDP (expected to show 5.1% year-over-year growth).

Conclusion: A Week Dominated by Trade, Data, and Central Bank Signals

The past week was overwhelmingly dominated by escalating trade tensions, a flurry of mixed economic data releases from major economies, and somewhat conflicting signals from central banks. Investor sentiment swung wildly with each new headline and development. While talk of potential stimulus from China adds a new layer of complexity to the global outlook, the undercurrents of persistent inflation concerns and significant geopolitical friction continue to shape market behavior and investor caution.

Frequently Asked Questions (FAQs) on the Week's Market Dynamics

Why did U.S. equity markets rise this week despite the heightened trade tension?

The gains in U.S. markets were largely driven by a period of midweek optimism following the announcement of a temporary 90-day pause on certain U.S. tariffs. However, the broader picture regarding trade remains highly volatile and uncertain.What is the key message coming from the U.S. Federal Reserve?

The Federal Reserve remains in a cautious stance, carefully balancing the need to control persistent inflation with the goal of avoiding a significant slowdown in economic growth. The path of future monetary policy is still highly data-dependent.Why are European equity markets struggling more than U.S. markets currently?

A combination of internal economic weakness, particularly in Germany and Italy (as seen in industrial production and GDP forecasts), coupled with external pressures from global trade frictions, is weighing heavily on investor sentiment in Europe.How is China responding to the new U.S. tariffs?

While China has implemented its own retaliatory tariffs, there are signals that Beijing may not pursue further direct tit-for-tat escalation as its primary strategy. Instead, the focus appears to be shifting towards potential domestic fiscal stimulus measures to support its economy.What will be the most important economic releases or events to watch this coming week?

Key economic data releases across the U.S. (retail sales, industrial production), Europe (ECB rate decision), and Asia—especially China's Q1 GDP figure—will offer critical insights into the health of the global economy and likely influence market direction.

Hashtags:

#MarketRecap #TradeWar #GlobalEconomy #InflationWatch #FederalReserve #ChinaStimulus #ECBDecision #StockMarkets #EconomicUpdate #FinancialNews #MarketVolatility #InvestmentStrategy #GlobalTrade

Subscribe to our Newsletter

Discover more