n a week teeming with geopolitical noise, surprising tariffs, and looming macroeconomic data, global markets displayed an almost eerie composure. Is this the calm before a storm, or are we witnessing the emergence of a more resilient, data-driven market regime?

Let’s break down what really moved markets this week—and what lies ahead for investors.

U.S. Markets: Steady, But Tense

Despite major developments, U.S. equity markets were relatively muted:

S&P 500: -0.3%

Nasdaq: -0.1%

Dow Jones: -1.0%

This seeming steadiness came amid news of significant tariffs: President Trump announced a 25% tariff on goods from Japan, South Korea, and others, plus a 50% tariff on copper—which caused copper futures to spike 13%.

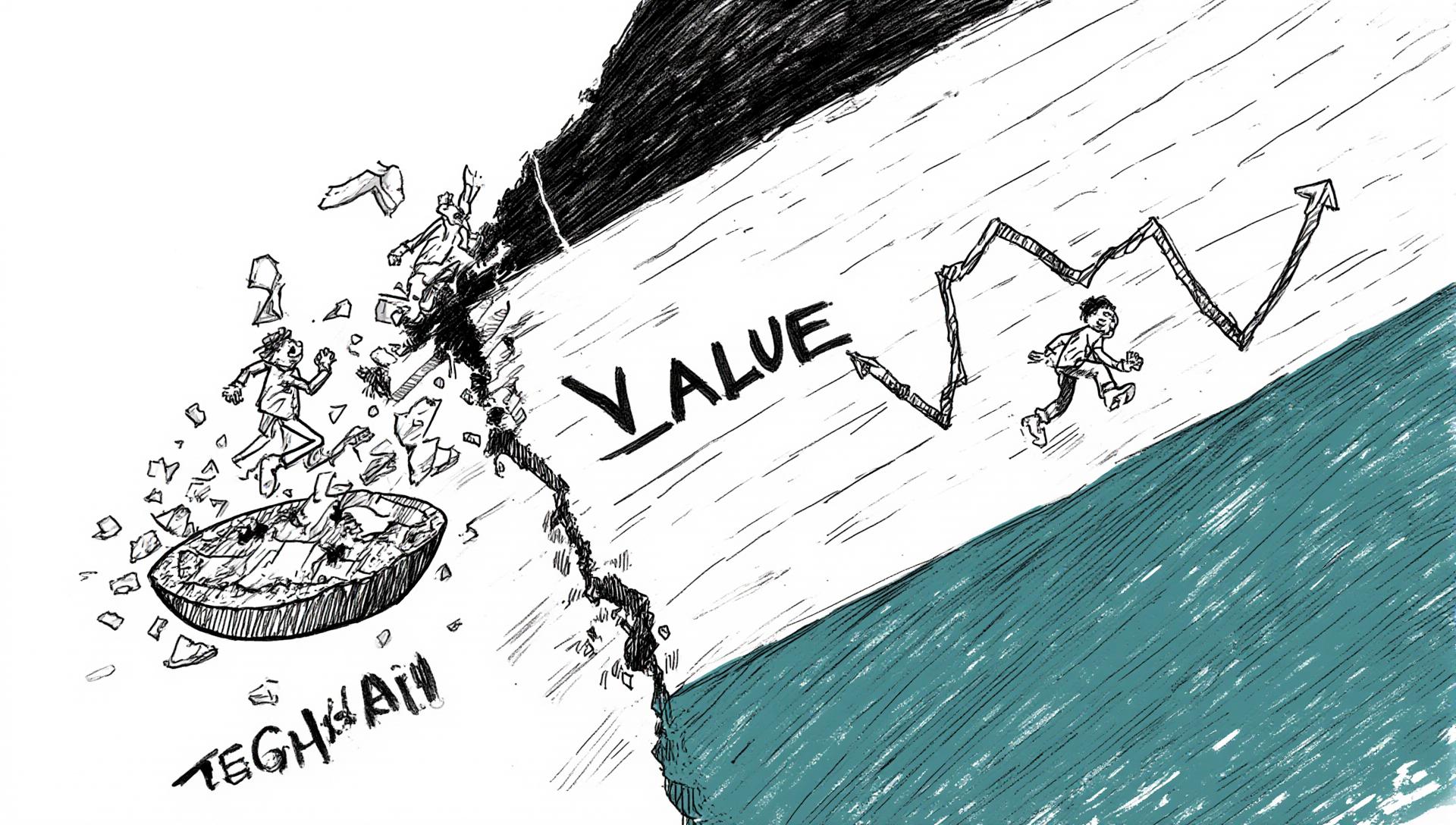

But the broader market reaction? Shrugs. Welcome to tariff fatigue, where investors have started treating trade tensions as background noise.

Meanwhile, the FOMC minutes showed a split outlook: some members hinted at potential rate cuts by July, others saw no cuts at all in 2025. Bond yields initially dipped, then rebounded—10-year Treasury closed at 4.42%, reflecting policy uncertainty.

Key Highlights:

Delta Airlines posted strong earnings and upbeat forecasts, lifting airline stocks.

Nvidia surpassed a $4 trillion market cap.

Bitcoin surged above $118,000, up 9%—possibly as a hedge amid monetary policy fog.

Takeaway: Markets are pausing, waiting for Q2 earnings and key inflation data to set the tone.

🇪🇺 Europe: Solid Gains with Fragile Foundations

European stocks performed well:

STOXX 600: +1.15%

DAX (Germany): +1.9%

CAC 40 (France): +1.7%

FTSE 100 (UK): +1.3%

Yet the underlying data paints a more fragile picture:

UK GDP contracted 0.1% in May (after -0.3% in April).

Eurozone retail sales declined 0.7%.

Germany saw a 1.2% bounce in industrial production, but exports dropped 1.4%.

Despite these figures, markets surged—likely pricing in future stimulus hopes or policy support like the UK's proposed mortgage guarantee scheme.

Caution: The rally may be on thin ice, vulnerable to renewed tariff risks or poor economic surprises.

🇯🇵 Japan: A Shaky Consumer Picture

Japan's markets slipped:

Nikkei 225: -0.6%

TOPIX: -0.17%

The drop followed:

New U.S. tariffs on Japanese goods (25% effective August 1).

Real wages plummeting 2.9% YoY in May.

Oddly, household spending rose 4.7%—a puzzling disconnect from wage data. With elections on July 20, political volatility could complicate the Bank of Japan’s policy normalization path.

🇨🇳 China: Stimulus Hopes Buoy Markets

CSI 300: +0.8%

Shanghai Composite: +1.1%

Hang Seng: +0.9%

The catalyst? Deflation.

Producer prices fell 3.6% YoY in June (3rd consecutive year of factory gate deflation).

Consumer prices ticked up just 0.1%, likely due to past stimulus.

Markets are betting heavily on Beijing delivering stronger stimulus, but if Q2 GDP or retail sales disappoint, investor patience could run out fast.

What to Watch: July 14–18, 2025

The upcoming week is data-heavy and could radically shift market dynamics:

United States

Tuesday: CPI (Inflation)

Wednesday: PPI, NAHB Housing Index

Thursday: Retail sales, jobless claims, import/export prices

Friday: Housing starts, building permits, Michigan consumer sentiment

China

Monday: Trade balance

Tuesday: Q2 GDP, industrial production, retail sales

Europe

Germany: ZEW Economic Sentiment Index (Tuesday)

UK: CPI (Wednesday), Unemployment (Thursday)

Japan

Thursday: Trade balance

Friday: CPI

Top 5 Market Risks to Watch Next Week

Sticky U.S. Inflation

Could derail 2025 rate cut hopes. Watch Tuesday’s CPI, Wednesday’s PPI.U.S. Consumer Slowdown

Retail sales and Michigan sentiment will test the health of household demand.China Stimulus Letdown

If Q2 GDP or retail sales fall short—and stimulus stays vague—markets may correct sharply.Tariff Volatility Escalates

Breakdown in negotiations, especially with the EU, could spook equities.Japan’s Political Risk

A weak election result might delay central bank actions and increase JPY volatility.

Final Thought

Markets may appear composed—but this week felt more like the calm before a data storm. Investors aren't ignoring risk; they're bracing for it. And perhaps the real danger lies not in the obvious headlines, but in emerging undercurrents we’ve yet to fully grasp.

FAQs

1. What is "tariff fatigue"?

It's the idea that markets are becoming desensitized to tariff announcements, viewing them as part of the background noise rather than immediate threats to pricing or sentiment.

2. Why is the CPI report on July 15 so important?

It’s a key gauge of inflation. A hotter-than-expected number could disrupt rate cut expectations and weigh on equities and bonds.

3. How does Japan’s election impact markets?

Political uncertainty could stall the Bank of Japan's policy plans, affecting both domestic equities and global interest rate trends.

4. Why are copper prices relevant?

Copper is a bellwether for global manufacturing and infrastructure. A 50% tariff has ripple effects across industries and regions.

5. What’s driving Bitcoin's surge?

Amid policy uncertainty and tariff noise, some investors are turning to Bitcoin as a hedge or alternative asset.

Hashtags

#GlobalMarkets #MarketRecap #EarningsSeason #InflationWatch #USEconomy #ChinaStimulus #TariffFatigue #InterestRates #Bitcoin #CopperPrices #JapanElections #Macroeconomics #StockMarketUpdate #MarketsDecoded #InvestmentStrategy #FinancialNews #CPI #RetailSales #RecessionRisks #FedWatch

Subscribe to our Newsletter

Discover more