This past week felt like an economic earthquake reverberating across global financial markets. What started as a sudden and sweeping tariff announcement in the U.S. rapidly evolved into one of the biggest global equity selloffs witnessed since the height of the COVID-19 pandemic. With financial markets reeling from the impact, central banks pausing to assess the damage, and global supply chains thrown into turmoil, investors worldwide were left grappling with two critical questions: what just happened—and what comes next? Let’s break down the chain of events and connect the dots from Wall Street to Tokyo, and from Frankfurt to Beijing.

U.S. Markets: Tariff Blitz Triggers Unprecedented Market Turmoil

The spark that ignited this global firestorm was a sweeping 25% tariff on all non-U.S. auto imports, announced unexpectedly by the U.S. administration. This sudden and aggressive move triggered a massive equity selloff across U.S. markets:

S&P 500: down a staggering 9.3% — marking its worst weekly performance since March 2020.

Nasdaq Composite: plunged 10%, with technology and communication services sectors leading the decline.

Dow Jones Industrial Average: fell 7.9%.

Russell 2000 (Small Caps): dropped 10% for the week, now down 30% from its recent peak and officially entering bear market territory.

The Federal Reserve’s Cautious Response to Market Volatility

Federal Reserve Chair Jerome Powell acknowledged the significant risks posed by these new tariffs, citing the potential for both higher inflation and slower economic growth. However, the Federal Reserve refrained from announcing any immediate policy shifts or interventions, emphasizing the considerable uncertainty surrounding the full economic impact of these tariffs.

U.S. Economic Data Presents Mixed Signals Amidst the Chaos

The Manufacturing PMI (Purchasing Managers' Index) dipped into contraction territory, with surveyed firms citing rising input costs directly tied to the new tariffs.

The Services PMI also declined but managed to remain just above the 50-point expansion threshold.

In a surprising counterpoint, non-farm payrolls showed an addition of 228,000 new jobs, indicating continued resilience in the U.S. labor market despite the broader turmoil.

A Surge Towards Safe-Haven Assets

10-year U.S. Treasury yields fell below 4% as investors aggressively sought the safety of government bonds.

Oil prices collapsed to $62 per barrel, their lowest level since April 2021, on fears of a global economic slowdown.

The U.S. Dollar Index (USDX) fell 1% for the week and is now down 5% year-to-date.

European Markets: Caught Directly in the Crossfire of U.S. Tariffs

Europe was not spared from the fallout. The U.S. auto tariffs hit the continent particularly hard, with no exemptions granted to European automakers:

Euro Stoxx 600: down over 8%.

German DAX & French CAC 40: both benchmark indices dropped by 8%.

Italy’s FTSE MIB: declined by more than 10%.

Stagflation Fears Rise as ECB Urges Caution

As inflation in the Eurozone remains sticky and economic growth falters, markets are increasingly fearful of a return to stagflation—a damaging combination of stagnant growth and high inflation. The European Central Bank (ECB) is under considerable pressure to cut interest rates as early as its April meeting, but influential leaders like Christine Lagarde are urging patience and caution amidst the profound uncertainty surrounding the trade situation.

Mixed Economic Data from the Eurozone

Headline inflation in the Eurozone declined to 2.2%.

Core inflation (excluding volatile food and energy) came in below expectations.

The unemployment rate fell to a record low of 6.1%.

UK Markets: Housing Sector Hit, Broader Market Slumps Considerably

The UK's FTSE 100 fell 7%, battered by both global headwinds and domestic policy changes. Recently increased transaction taxes have notably cooled the UK housing market:

House prices stagnated in March.

Mortgage approvals dropped to a six-month low.

The Bank of England remains cautious and is unlikely to ease monetary policy until the trade and inflation picture becomes significantly clearer.

Japan: Export Engine Comes Under Severe Threat from Tariffs

Japan’s equity markets dropped sharply in response to the U.S. tariff announcement:

Nikkei 225: down 9%.

TOPIX: down 10%.

The U.S. tariffs—which now total nearly 50% on Japanese auto imports when combined with existing measures—sparked widespread fears of a broader economic slump in Japan. Japanese government bond yields fell, and the yen strengthened to 146 against the U.S. dollar, adding further pressure on exporters and raising deflationary concerns.

Bank of Japan (BoJ) Governor Kazuo Ueda signaled that previously planned interest rate hikes may now be postponed, citing the growing global economic uncertainty.

China: Strikes Back Hard with Retaliatory Measures

China wasted no time in responding forcefully to the U.S. tariffs:

Announced a 34% retaliatory tariff on a range of U.S. goods, effective April 10.

Imposed rare earth export restrictions.

Launched investigations into U.S. medical firms operating in China.

Implemented bans on U.S. poultry and sorghum imports.

Blacklisted 11 U.S. defense contractors.

These aggressive retaliatory measures signal a significant deepening of the trade rift between the two economic superpowers. Analysts warn of a potential 1–2% hit to China’s GDP growth but expect Beijing to launch targeted stimulus measures to soften the economic blow.

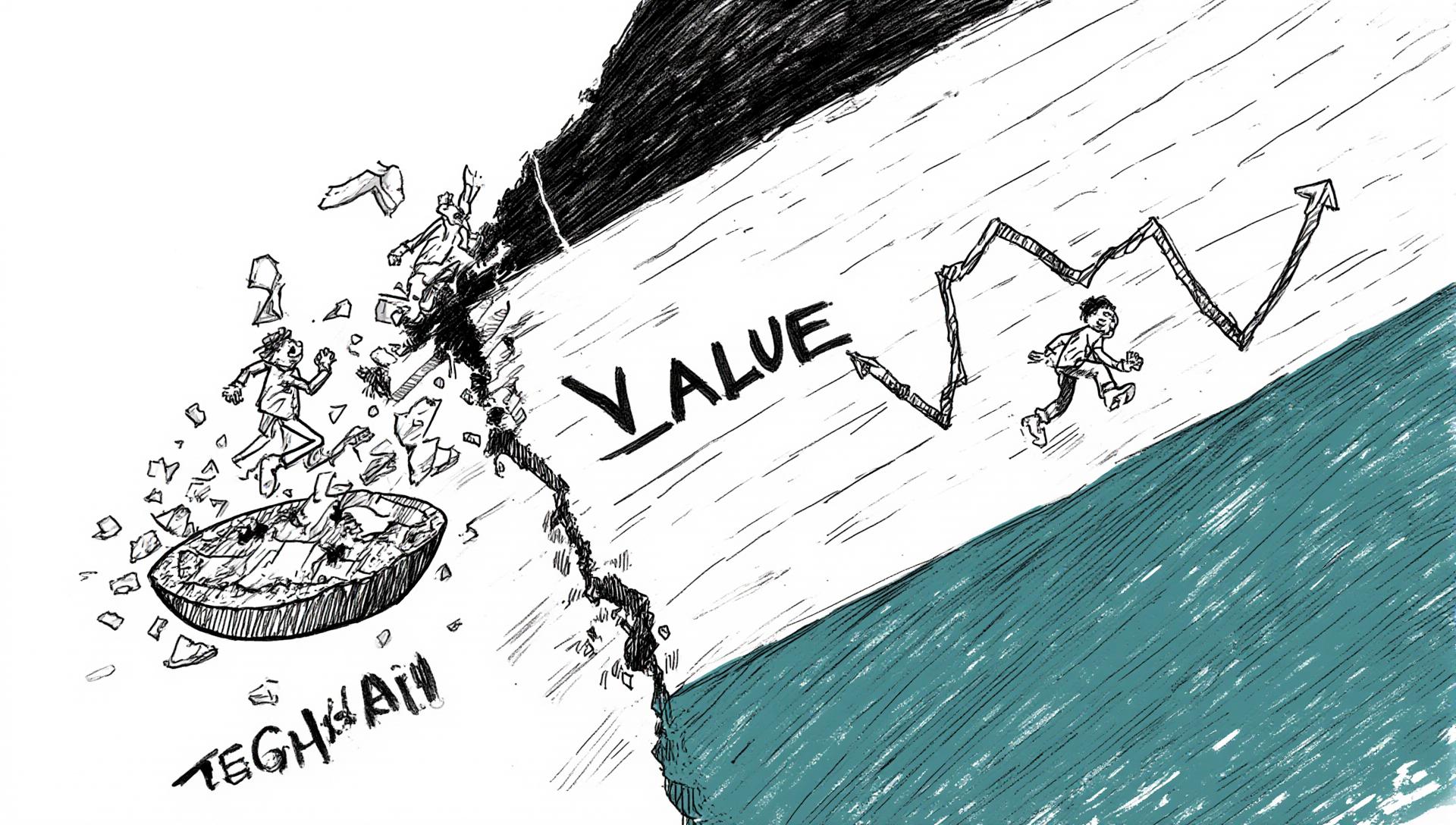

The Global Picture: A Cascade of Interconnected Shockwaves

This week’s dramatic events clearly illustrate the extreme interconnectivity of the modern global economy. A single U.S. policy decision set off a domino effect that cascaded across continents, profoundly impacting equities, commodities, currencies, and central bank strategies in real time.

Key Economic Data to Watch: April 7 Onward

Eurozone retail sales.

U.S. wholesale inventories.

FOMC (Federal Open Market Committee) meeting minutes from the U.S. Federal Reserve.

U.S. CPI (Consumer Price Index) and PPI (Producer Price Index) inflation reports.

UK GDP figures.

U.S. weekly jobless claims and the University of Michigan Consumer Sentiment Index.

Conclusion: A Stark Wake-Up Call for Global Markets

This past week served as a jarring wake-up call—a stark reminder that geopolitical shocks can reshape financial markets virtually overnight. With central banks worldwide exercising extreme caution and trade tensions intensifying rapidly, uncertainty has firmly become the new norm for investors. Stay tuned and stay informed. The next set of economic data points could either fuel further market volatility or, perhaps, offer a fleeting moment of stability in these turbulent times.

Frequently Asked Questions (FAQs) on the Recent Market Turmoil

Why did global financial markets crash so severely last week?

A sweeping and unexpected U.S. tariff imposed on all non-U.S. auto imports triggered a worldwide equity selloff. This was compounded by existing fears of persistent inflation and slowing global economic growth.What is the U.S. Federal Reserve doing in response to this market volatility?

Federal Reserve Chair Jerome Powell acknowledged the significant economic risks posed by the tariffs but stated that the Fed would hold off on any immediate policy changes, citing the high degree of uncertainty about the tariffs' ultimate impact.How is Europe responding to the trade fallout and market instability?

European markets are anticipating an interest rate cut from the European Central Bank (ECB). However, the ECB remains cautious due to the unpredictable effects of the trade situation on both inflation and economic growth prospects in the Eurozone.What was China’s specific response to the new U.S. tariffs?

China retaliated swiftly and strongly with new tariffs on U.S. goods, export restrictions on critical materials like rare earths, blacklisting of U.S. companies, and various industry-specific sanctions, signaling a significant and potentially long-term escalation of trade tensions.What key economic data should investors watch most closely in the coming week?

Key economic data releases this week—including U.S. CPI and PPI inflation reports, central bank meeting minutes, and GDP figures from the UK—will be critical in helping investors and policymakers understand potential future policy paths and market direction.

Hashtags:

#MarketRoundup #GlobalMarkets #TradeTensions #EquitySelloff #TariffShock #InflationWatch #FedPolicy #ChinaTrade #InvestSmart #WeeklyWrap #MarketVolatility #EconomicNews #GlobalEconomy #SupplyChainDisruption

Subscribe to our Newsletter

Discover more